(Note: This article originally appeared on the June 7, 2022 AgManager.info page from K-State’s Department of Agricultural Economics.)

What is Annual Forage Insurance?

Annual Forage (AF) insurance is a rainfall index product similar to Pasture, Rangeland, and Forage Insurance (PRF). Alfalfa and perennial range can be insured under PRF. If you grow annual crops for forage (this includes annual crops used for grazing, haying, grazing/haying, grain/grazing, green chop, grazing/green chop, or silage), AF can be used to help insure against reduced forage yield due to less precipitation than normal during the producer-selected growing season.

When rainfall falls below a set amount, a payout is provided. These payouts, called indemnities, could be used to cover losses from decreased forage production, including purchasing supplemental feed sources during a drought or future restocking. Precipitation is measured locally, in an approximately 14x16 mile area called a “grid.” A producer selects the months, weight (importance) of months, and % precipitation they want to insure for.

Where is Annual Forage Insurance used in Kansas?

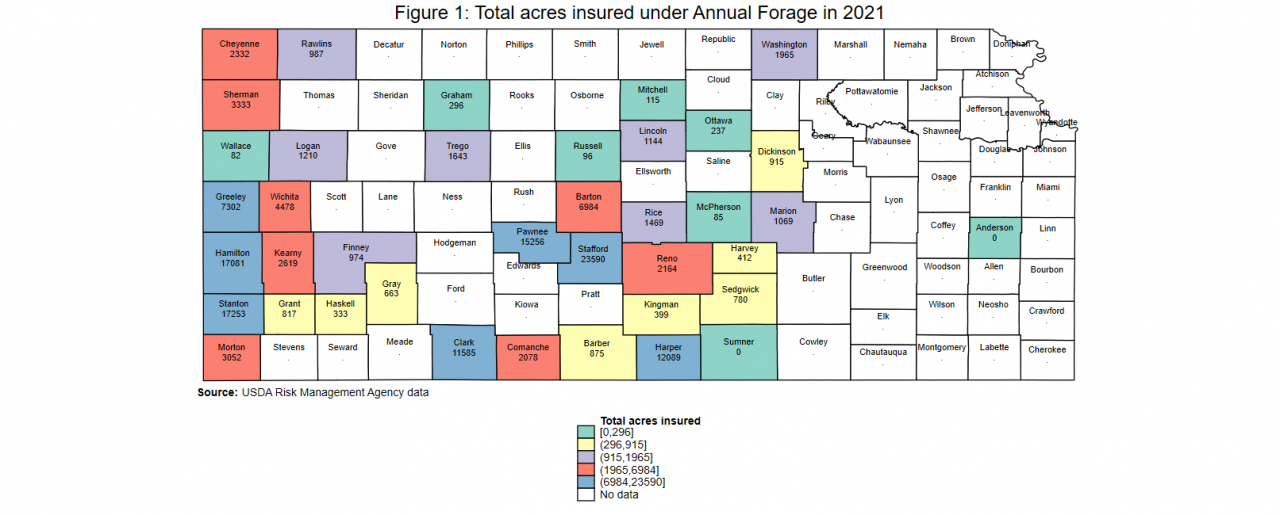

In 2021 almost 162,000 acres were covered by AF, up from about 94,000 acres in

2020. Similarly, the total value of production insured (insurance liabilities or guarantee) increased from $16 million in 2020 to $26 million in 2021. In Figure 1, we can see that AF was used in many western and south-central Kansas counties in 2021, but not in the eastern third of the state. Annual forage insurance has only been used in Kansas since 2014.

Does it pay?

Annual Forage insurance pays out indemnities when the level of rainfall relative to the historic average within the producer’s grid is lower than the (producer-selected) coverage level. For example, if rainfall is 80% of the historic level and the producer selects an 85% coverage level, there would be indemnity. However, a 75% coverage level would not receive an indemnity. Coverage levels can range from 70 to 90%; the higher the coverage level, the higher the premium and the higher the likelihood and size of a payout. The Federal government provides a premium subsidy or shares in the cost of AF premium.

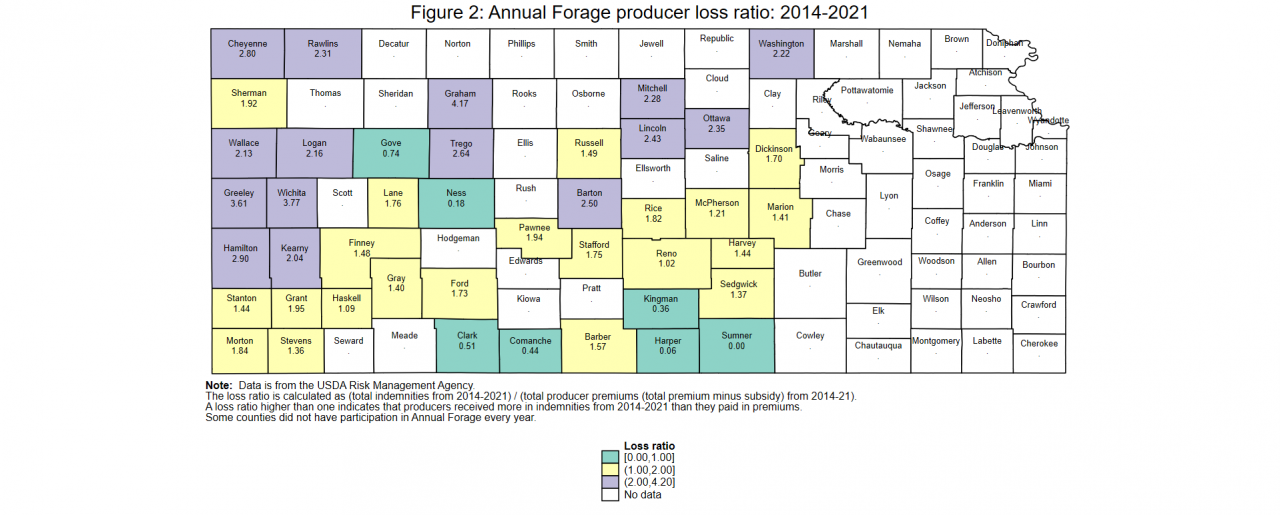

From 2014-present, Kansas producers have paid nearly $11 million in AF premiums and received over $22 million in indemnities. The highest level of indemnities (relative to premium) was paid in 2018 and the lowest in 2019. In Figure 2, we report the aggregate producer loss ratio from 2014-2021 across Kansas counties.

Most counties experienced a producer loss ratio greater than one or received more in indemnities than was paid in premiums. However, the experience varies across counties, with northwest counties having higher producer loss ratios. These patterns suggest that south central Kansas may have been relatively wet from 2014-21, while northwestern Kansas was relatively dry.

The coverage period, or growing season, as discussed in the next section, may also influence payouts.

What are the key producer decisions?

The producer must select a coverage level of 70-90% and productivity factor of 60-150%, which influences the level of local rainfall necessary to trigger a payout and the value of payouts, respectively. Similar to PRF, producers must also select what months to use AF. However, these months, or intervals, are somewhat less flexiblethan PRF.

The producer must first select one or more of 4 ‘growing seasons’:

(1) September to March,

(2) December to June,

(3) March to September or

(4) June to November.

The forage crop must be planted between early and final planting dates, similar to other crop insurance policies. The early and final planting dates are unique to each growing season, with the early planting typically 1.5 months before the beginning month of the growing season and late planting 1.5 months after the beginning month of the growing seasons.

For example, earliest planting date for growing season 1 is July 16 and the final planting date is Oct. 15. Next, 3 2-month intervals within the 7-month ‘growing season’ must be selected and assigned weights (for example, 30%, 30%, and 40%). No single month can be insured twice (overlap) within 1 of the 4 ‘growing seasons.’ No period can have a weight higher than 40%, so 3 2-month periods must be selected within a ‘growing season.’ Other key decisions, including grid selection, can be discussed with an insurance agent or by visiting the AF decision support tool at http://af.agforceusa.com/ri.

Examples of AF Growing Seasons Insured:

1. A producer planted winter wheat for dual-purpose use (graze plus grain) in

September 2020 in Clark County (grid 20521) and used AF in Growing Season 1: September (2020)-March (2021). Wheat grown for dual-purpose is insurable, but at a 60% lower county base value (see more details below). They selected a coverage level of 80% and a productivity factor of 100%. Since fall growth is most important for dual-purpose, they selected the Oct-Nov interval at the highest rate possible at 40% weight, the Dec-Jan interval at a 40% weight, and the Feb-Mar interval at 20% weight.

The producer would have paid a premium of $7 per acre and received no indemnities. The premium is relatively lower than the examples below because the base value, or the value of the insured forage crop, is 60% lowerunder the dual-purpose option.

2. A producer in Morton County (grid 20813) planted winter triticale in late October 2020 and used AF in Growing Season 2: December (2020) - June( 2021). They selected a coverage level of 90% and a productivity factor of 100%. They insured all periods equally: Dec-Jan interval at a 33% weight, Feb-Mar interval at a 33% weight, and Apr-May interval at a 34%weight.

The producer would have paid a premium of $25 per acre and received an indemnity of $63 per acre for lower-than-normal rainfall in the Feb-March and Apr-May intervals. Rainfall was much lower than average in the late winter and early spring, so indemnities were relatively high.

3. A producer plants corn silage in April 2020 in Harper County (grid 20227) for Growing Season 3. They insure using the following weights: Mar-Apr at 40%, May-Jun at 40%, Jul-Aug at 20%. They select a coverage level of 90% and a productivity factor of 125%.

The producer would pay a premium of $27 per acre and receive an indemnity of $50 per acre, due to a rainfall index of 48.6 during the May-June interval. In other words, rainfall during May-June interval was 48.6% of the historic average.

4. A producer plants forage sorghum in June 2020 in Hodgeman County (grid 22021) during Growing Season 4. The producer wants to ensure good growth early in the growing season and will harvest in October, so insures Jun-July at 40%, Aug-Sep at 40%, and Oct-Nov at 20%. They select a coverage level of 75% and a productivity factor of 80%. The producer would pay a premium of $6 per acre and receive an indemnity of

$4 per acre, for lower-than-average rainfall during the Oct-Novinterval.

These examples were estimated using the AF Decision Support Tool at http://af.agforceusa.com/ri and are for demonstration purposes only. Some insurance agents have their own decision support software; only an insurance agent can provide official premium estimates.

What are some advantages and disadvantages of using Annual Forage insurance?

The primary disadvantage of AF is that it doesn’t cover low moisture on your farm or fields, it covers low moisture in your area or grid. Before using AF, a producer needs to understand this risk: they might receive a payment when they have sufficient moisture or not get a payment when they experience low rainfall. Also it could be extremely dry for a two-month insurance period (interval), resulting in low forage yield, yet a large rainfall event on the last day of the period could make the period ineligible for a payment.

An advantage of AF is that payments are calculated automatically based on actual precipitation and made relatively quickly. Unlike grain crops that typically have scale tickets, forage may be harvested and used by the grower themselves without good yield documentation or the forage might be grazed. Thus this program makes reporting much simpler. Further, a producer gets to select what months they want coverage in and how much coverage they want. While some learning is required with any insurance product and AF requires an initial time investment, it is a relatively simple insurance product. This is especially likely after the first year or two of participation; a good relationship with your insurance agent can also make a big difference here.

What else should be considered?

• The sign-up deadline is July 15, with premium billing a year later, around August. Annual forage can be purchased from a local crop or livestock insurance agent: https://www.rma.usda.gov/informationtools/agentlocator

• Premiums vary based on location, growing season, coverage leverage, and productivity factor; a producer could pay from $3-50 per acre. Higher premiums reflect a higher likelihood and value of a payout.

• Acreage reporting dates are on the “final planting date” for each growing season, which is approximately 3 months after the earliest planting date for each growing season. Acreage reporting is an important deadline — if the acreage isn’t used for annual forage or if other conditions are not met, then the policy may not “attach”: no payouts are made, and the producer doesn’t pay a premium. A producer using AF should discuss and stay in touch with their insurance agent about acreage reporting deadlines

.• There is a “dual use option” for small grains used for both grazing and grain production, see the RMA or Texas A&M fact sheets for more information. This option is available for growing season 1 only and the county base value is decreased to 40% of the full county base value. This lowers the insurance guarantee, or both the premium and potential payouts. The dual option would be used when the crop is grazed out the winter and harvested in the summer; the producer would also purchase a separate multi-peril crop insurance policy (i.e. a revenue protection (RP) policy for wheat).

• Indemnities are based on changes from normal or average precipitation. If certain months are typically dry, they would have to be even drier for an indemnity to be triggered.

• A producer may want tolook at historic grid precipitation indices and compare them to their individual precipitation and forage yield and quality experience. Annual Forage uses the same grids as PRF; historical grid indices are available at https://prodwebnlb.rma.usda.gov/apps/prf# on the ‘Historical Indices’ tab.

• The productivity factor can be used to adjust the county base value, or a county-level estimate of the average local value of annual forage production, upwards or downwards. Producers who have higher value crops or want more protection can select a higher productivity factor and vice versa for a lower productivity factor. The value of indemnities is based on the county base value and productivity factor, in addition to the level of actual rainfall relative to the coverage level.

Jennifer Ifft, Department of Agricultural Economics

John Holman, Agronomist, Southwest Research and Extension Center

Sylvanus Gaku, Department of Agricultural Economics

Tags: forage crop insurance