What is Annual Forage Insurance?

Annual Forage (AF) insurance is a rainfall index product for annual crops produced for forage.[1] AF insures against reduced forage yield due to less precipitation than normal. When rainfall falls below a set amount, a payout or indemnity is made. Precipitation (rainfall) is measured locally, in an approximately 14x16 mile area called a “grid”. A producer selects the months (intervals), weight (importance) of months, and % precipitation (coverage level) they want to insure for.

The deadline to purchase AF for any annual forage crop produced over the next calendar year is July 15.

A producer must make three major choices:

- Coverage level of 70-90%: The coverage level determines the level of local rainfall necessary to trigger a payout. The higher the coverage level, the higher the premium, and the higher the likelihood and size of a payout. The Federal government provides a premium subsidy or shares in the cost of AF premium.

- Productivity factor of 60-150%: The productivity factor scales AF premiums and potential indemnities down or up. For example, the highest productivity factor has the highest premium but also the highest potential payout when rainfall is lower than normal.

- Growing season and intervals: Producers must select what months to use AF. These months, or intervals, must correspond to the producer-selected ‘growing season’, or the period in which the forage crop is grown.

How did Annual Forage change this year?

The USDA Risk Management Agency (RMA) recently announced several changes to AF, that were designed to increase flexibility for producers. A major change is that AF includes more growing seasons; previously only 4 growing seasons were offered. Now there are 12 growing seasons, that cover the entire year. Each growing season is 7 months long.

- The first growing season for crop year 2024 begins in September 2023 and ends in March 2024. The earliest planting date is July 16, 2023 and the final planting date is August 31, 2023. Acreage reporting is due on September 5, 2023.

- Growing seasons 5 and 6 (the growing seasons beginning in February and March) are not allowed in Kansas; any forage crops planted in January or February would be reported in growing season 7.

- The final (12th) growing season for crop year 2024 begins in August 2024 and ends in February 2025. The earliest planting date is July 1, 2024, and the final planting date is July 31, 2024. Acreage reporting is due on August 5, 2024.

The other major change is that a producer is not required to insure all eligible acres. Other changes are discussed here https://www.rma.usda.gov/en/News-Room/Press/Press-Releases/2023-News/USDA-Announces-Modifications-to-the-Annual-Forage-and-Rainfall-Index-Program.

How does selection of growing seasons and intervals work?

The forage crop must be planted between early and final planting dates, similar to other crop insurance policies. The early and final planting dates are unique to each growing season, with the early planting typically 1.5 months before the beginning month of the growing season and late planting right before the beginning month of the growing season.

Next, 3 2-month intervals within the growing season must be selected and assigned weights (for example, 30%, 30%, and 40%). No single month can be insured twice (overlap) within a growing season and no interval can have a weight higher than 40%. One exception is that 50% weights are allowed for intervals in growing seasons 10, 11, and 12, which begin in June, July, and August, respectively.

Other key decisions, including grid selection, can be discussed with an insurance agent or by visiting the AF decision support tool at http://af.agforceusa.com/ri.

Example:

A producer planted forage sorghum in June 2022 in Hodgeman County (grid 22021) during Growing Season 11. The producer wanted to ensure good growth early in the growing season and harvest in October, so selected Jul-Aug at 50% and Sept-Oct at 50% (50% interval weights are allowed only during growing seasons 10, 11, and 12). They selected a coverage level of 90% and a productivity factor of 100%. The producer paid a premium of $22 per acre and received an indemnity of $92 per acre, for substantially lower-than-average rainfall during both intervals.

This example was estimated using the AF Decision Support Tool at http://af.agforceusa.com/ri and is for demonstration purposes only. The example uses current policy choices applied to 2022. Some insurance agents have their own decision support software; only an insurance agent can provide official premium estimates.

Where is Annual Forage Insurance used in Kansas?

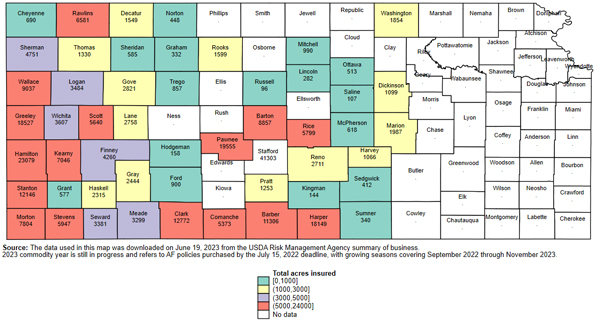

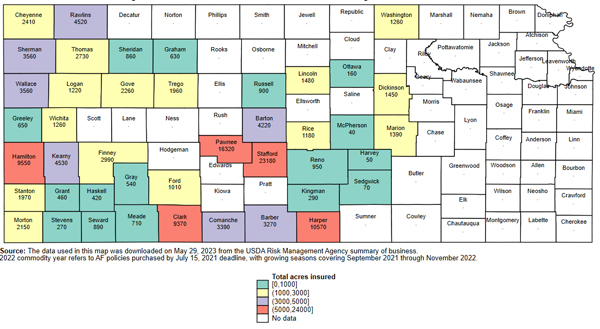

In 2023 (commodity year)[2], over 281,000 acres were covered by AF. In 2022 (commodity year), over 135,000 acres were covered by AF, down from over 160,000 acres in 2021 (commodity year). Figures 1 and 2 show that AF is used in many western and south-central Kansas counties, but not in the eastern third of the state. The total value of production insured (insurance liabilities or guarantee) was about $52 million in 2023 and $26 million in both 2021 and 2022. Annual forage insurance has only been used in Kansas since 2014.

Figure 1. Total acres enrolled in Annual Forage insurance in 2023. Source: AgManager.info

Figure 2. Total acres enrolled in Annual Forage insurance in 2022. Source: AgManager.info

Does it pay?

Annual Forage insurance pays out indemnities when the level of rainfall relative to the historic average within the producer’s grid is lower than the (producer-selected) coverage level. For example, if rainfall is 80% of the historic level and the producer selects an 85% coverage level, there would be indemnity. However, a 75% coverage level would not receive an indemnity.

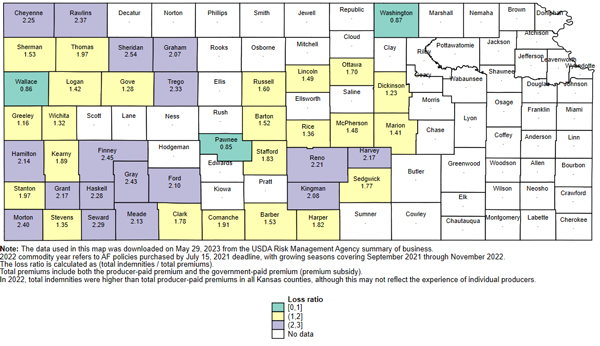

In 2022 (commodity year), over $10 million in indemnities, averaging about $77 per insured acre, were paid out to Kansas producers using AF. Kansas producers paid about $2.84 million in premiums. 2022 county-level loss ratios, or the ratio of total indemnities to total premiums, are displayed in Figure 3. While loss ratios are affected by producer-selected coverage ratios and intervals, as well as other factors, high loss ratios in 2022 reflect the then-emerging and widespread drought.

Commodity year 2023 has not yet been completed for AF; payments to date have totaled over $19 million, in comparison to about $6.1 million in producer-paid premiums. Given the ongoing drought, loss ratios will likely be at least as high as commodity year 2022.

Figure 3. Annual Forage Insurance 2022 loss ratios. Source: AgManager.info

What are some advantages and disadvantages of using Annual Forage insurance?

The primary disadvantage of AF is that it doesn’t insure your farm or fields, it covers low moisture in your area or grid. Before using AF, a producer needs to understand this risk: they might receive a payment when they have sufficient moisture or not get a payment when they experience low rainfall. Further, it could be extremely dry for a two-month insurance period (interval), resulting in low forage yield, yet a large rainfall event on the last day of the period could make the period ineligible for a payment.

An advantage of AF is that payments are calculated automatically based on actual precipitation and made relatively quickly. Unlike grain crops that typically have scale tickets, forage may be harvested and used by the grower themselves without yield documentation or the forage might be grazed. Further, a producer can select what months they want coverage in and how much coverage they want. While some learning is required with any insurance product and AF requires an initial time investment, it is a relatively simple insurance product. This is especially likely after the first year or two of participation; a good relationship with your insurance agent makes a big difference.

What else should be considered?

- The sign-up deadline is July 15, with premium billing a year later, around August. Annual forage can be purchased from a local crop or livestock insurance agent: https://www.rma.usda.gov/informationtools/agentlocator

- Premiums vary based on location, growing season, coverage leverage, and productivity factor; a producer could pay from $3-50 per acre. The average producer-paid premium per acre in 2022 was about $21 per acre. Higher premiums reflect a higher likelihood and value of a payout.

- Acreage reporting is an important deadline—if the acreage isn’t used for annual forage or if other conditions are not met, then the policy may not “attach”: no payouts are made, and the producer doesn’t pay a premium. A producer using AF should discuss and stay in touch with their insurance agent about acreage reporting deadlines.

- There is a “dual use option” for small grains used for both grazing and grain production, see the RMA or Texas A&M fact sheets for more information. This option is available for growing seasons 1-3 only and the county base value is decreased to 40% of the full county base value. This lowers the insurance guarantee, or both the premium and potential payouts. The dual option would be used when the crop is grazed out in the winter and harvested in the summer; the producer would also purchase a separate multi-peril crop insurance policy (i.e. a revenue protection (RP) policy for wheat).

- Indemnities are based on changes from normal or average precipitation. If certain months are typically dry, they would have to be even drier for an indemnity to be triggered.

- A producer may want to look at historic grid precipitation indices and compare them to their individual precipitation and forage yield and quality experience. Annual Forage uses the same grids as PRF; historical grid indices are available at https://prodwebnlb.rma.usda.gov/apps/prf# on the ‘Historical Indices’ tab.

- The productivity factor can be used to adjust the county base value, or a county-level estimate of the average local value of annual forage production, upwards or downwards. Producers who have higher-value crops or want more protection can select a higher productivity factor and vice versa for a lower productivity factor. The value of indemnities is based on the county base value and productivity factor, in addition to the level of actual rainfall relative to the coverage level.

This material is based upon work supported by USDA/NIFA under Award Number 2021-70027-34694.

For more information about this publication and others, visit AgManager.info

Jenny Ifft, Agricultural Policy Extension Specialist

jifft@ksu.edu

John Holman, Cropping Systems Agronomist – Garden City

jholman@ksu.edu

Sylvanus Gaku, Doctoral Student – Agricultural Economics

[1] This includes annual crops used for grazing, haying, grazing/haying, grain/grazing, green chop, grazing/green chop, or silage.

[2] 2023 commodity year is still in progress and refers to AF policies purchased by the July 15, 2022 deadline, with growing seasons covering September 2022 through November 2023.